We were reading an article in the WAPO about inequality in America by James Q. Wilson, Published: January 26.

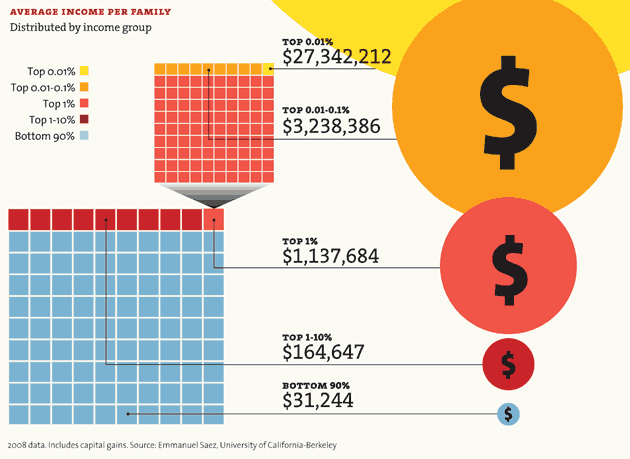

The writer tried to define the inequality problem int the US as the rich v. the poor while clearly the Obama administration has defined it as a tax issue between the middle class and the affluent.

Had the Obama administration framed the economic problems in the US in terms of the rich v.the poor, Republicans would have engaged in a welfare state attack against welfare queens and lazy Americans who need to get jobs. The country heard a lot of this rhetoric when Newt Gingrich was speaker of the House in the 1990s.

It is trickier for the GOP to attack programs like unemployment compensation and food stamps when the middle class started losing their jobs and homes.

Had the Obama administration framed the economic problems in the US in terms of the rich v.the poor, Republicans would have engaged in a welfare state attack against welfare queens and lazy Americans who need to get jobs. The country heard a lot of this rhetoric when Newt Gingrich was speaker of the House in the 1990s.

It is trickier for the GOP to attack programs like unemployment compensation and food stamps when the middle class started losing their jobs and homes.

The article then talks about social mobility and points out the income of both the rich and poor fluctuate over a given time period. The author ignores studies that show Americans enjoy less economic mobility than their peers in Canada and much of Western Europe. See

http://www.nytimes.com/2012/01/05/us/harder-for-americans-to-rise-from-lower-rungs.html?pagewanted=all

The professor points out that incomes for people for college degrees have risen, but doesn't mention that overall middle class wages have been squeezed and have been declining since the 1980s: see

http://en.wikipedia.org/wiki/Middle_class_squeeze.

These examples suggest the author is selectively looking at data and only presenting data that supports his conservative view points. This is not the mark of a scholar.

These examples suggest the author is selectively looking at data and only presenting data that supports his conservative view points. This is not the mark of a scholar.

The author then talks superficially about the GINI index which is dangerously high in the US. A high GINI portends social and political instability, something the author also does not mention. The US GINI coefficient is historically high at 46.8. in 1929, It was estimated to be 45.0.

The author then says:

The author then says:

Sweden has maintained a low Gini index in part by having more progressive tax rates. If Americans wanted to follow the Swedish example, they could. But what is the morally fair way to determine tax rates — other than taxing everyone at the same rate? The case for progressive tax rates is far from settled . . .

The author is making an unsubstantiated conservative value judgement that everyone should be taxed at the same rate which is actually the way most American taxes work. Flat taxes likes sales and real estate taxes are regressive.

The one progressive tax we have in the US is income tax, the target of most conservative dialogue on taxes.

The one progressive tax we have in the US is income tax, the target of most conservative dialogue on taxes.

Because there are inequalities in income that are more explainable by birth right and luck, Theodore Roosevelt create the progressive tax system. Roosevelt stated:

A heavy progressive tax upon a very large fortune is in no way such a tax upon thrift or industry as a like would be on a small fortune.

When we had a robust progressive tax system prior to the 1980s, the US had a vibrant middle calls and a small deficit.

Was this system "fair to the rich?" Perhaps not, but the system worked. The national debt was under control. In the US we are no that fair to the poor. Do we need to be fairer to a much smaller elite?

Ronald Reagan flattened the tax system and drooped the marginal tax rate on the most affluent Americans was cut to 50 per cent and then to 28 per cent. After Bill Clinton, GW Bush lowered the tax rates for affluent Americans and also reduced short term capital gains to 15 per cent. He was also the only president to start a war with raising income tax.

Does James Q Wilson have conservative biases in his article? He defined the tax problem in the US incorrectly and made a glaring assumption that only flat taxes are fair. Fair to whom: the affluent? He glossed over the importance of the GINI coefficient.

This is is sloppy work for a professor.

James Q. Wilson, a former professor at Harvard University and UCLA, is the Ronald Reagan professor of public policy at Pepperdine University.

Pepperdine is considered to be one of the most conservative universities in the US. Still a professor should know better to publish an article with such blatant biases based upon a glaring assumption.

A scholarly article should not compare apples to oranges and makes an a priori value judgment about tax fairness.

Does Rightardia blame the rich about inequality. No we blame the GOP, and the Republican Party Trojan Horse tax policy: supply side economics.

see http://www.washingtonpost.com/opinions/angry-about-inequality-dont-blame-the-rich/2012/01/03/gIQA9S2fTQ_story.html?tid=pm_pop

Was this system "fair to the rich?" Perhaps not, but the system worked. The national debt was under control. In the US we are no that fair to the poor. Do we need to be fairer to a much smaller elite?

Ronald Reagan flattened the tax system and drooped the marginal tax rate on the most affluent Americans was cut to 50 per cent and then to 28 per cent. After Bill Clinton, GW Bush lowered the tax rates for affluent Americans and also reduced short term capital gains to 15 per cent. He was also the only president to start a war with raising income tax.

Does James Q Wilson have conservative biases in his article? He defined the tax problem in the US incorrectly and made a glaring assumption that only flat taxes are fair. Fair to whom: the affluent? He glossed over the importance of the GINI coefficient.

This is is sloppy work for a professor.

James Q. Wilson, a former professor at Harvard University and UCLA, is the Ronald Reagan professor of public policy at Pepperdine University.

Pepperdine is considered to be one of the most conservative universities in the US. Still a professor should know better to publish an article with such blatant biases based upon a glaring assumption.

Does Rightardia blame the rich about inequality. No we blame the GOP, and the Republican Party Trojan Horse tax policy: supply side economics.

see http://www.washingtonpost.com/opinions/angry-about-inequality-dont-blame-the-rich/2012/01/03/gIQA9S2fTQ_story.html?tid=pm_pop

Subscribe to the Rightardia feed: http://feeds.feedburner.com/blogspot/UFPYA

Rightardia by Rightard Whitey of Rightardia is licensed under a Creative Commons Attribution 3.0 Unported License.

Permissions beyond the scope of this license may be available at rightardia@gmail.com.

Rightardia by Rightard Whitey of Rightardia is licensed under a Creative Commons Attribution 3.0 Unported License.

Permissions beyond the scope of this license may be available at rightardia@gmail.com.

No comments:

Post a Comment